This help center article provides an overview of loan modeling in Aurora’s financial simulations and instructions on how to model common loans on the market. Future system owners should consult a tax professional to ensure that they are eligible for the ITC and loan interest deductions as applicable.

Setting up Loans

Loans are represented as Financing Products in Aurora. Aurora provides several default loans to choose from, and account admins can add additional Financing Products to quickly model all of their offered financial options. For more information on how to add Financing Products, check out this article from our Help Center - Financing Products

Loan Parameters

All loans in Aurora take the following parameters:

Principal: The percentage of system cost minus grants that will be financed with the loan.

Dealer Fee: The percentage of the loan principal that the financial institution takes as a fee. The principal for this loan is increased to be equal to the cost in the Pricing Page plus the financier's cut.

Incentives Apply to Dealer Fee: Check this to have cost-based incentives apply to the loan principal plus the dealer fee.

Interest is Tax Deductible: Choose whether the loan interests are tax deductible.

Interest Rate: The proportion of a loan that is charged as interest to the borrower, expressed as an annual percentage of the loan outstanding.

Duration: The term of the loan in months.

Picking the Right Loan Type

Solar loan products are sometimes difficult to classify between loan types. At Aurora we try to make all of them able to be modeled, but as payment structures vary between financiers, there is no one-size-fits-all option. Here’s a list of which loan type to use for certain providers (if you don’t see your provider listed, contact our support team and we will add it)

For Dividend, Loanpal, Sunlight Financial or Mosaic: use the Solar-Style Loan

These companies expect the ITC portion of the loan to be paid down around month 18.

During the first 18 months, interest is based on the entire loan principal.

There is no payment due during the 1st month, but they do charge interest which must be paid off later.

If the prepayment is not completed, the monthly payment due increases to cover the ITC amount.

For Sunnova: use a combination of a Mortgage-Style Loan and a Bullet Loan, or a Mortgage-Style Loan and a No-Payment Loan.

These companies expect the ITC portion of the loan to be paid down around month 18.

During the first 18 months, interest is based only on the non-ITC portion of the loan principal.

If the prepayment is not completed, the accrued interest on the ITC-portion of the loan is added to the loan principal and the monthly payments increase.

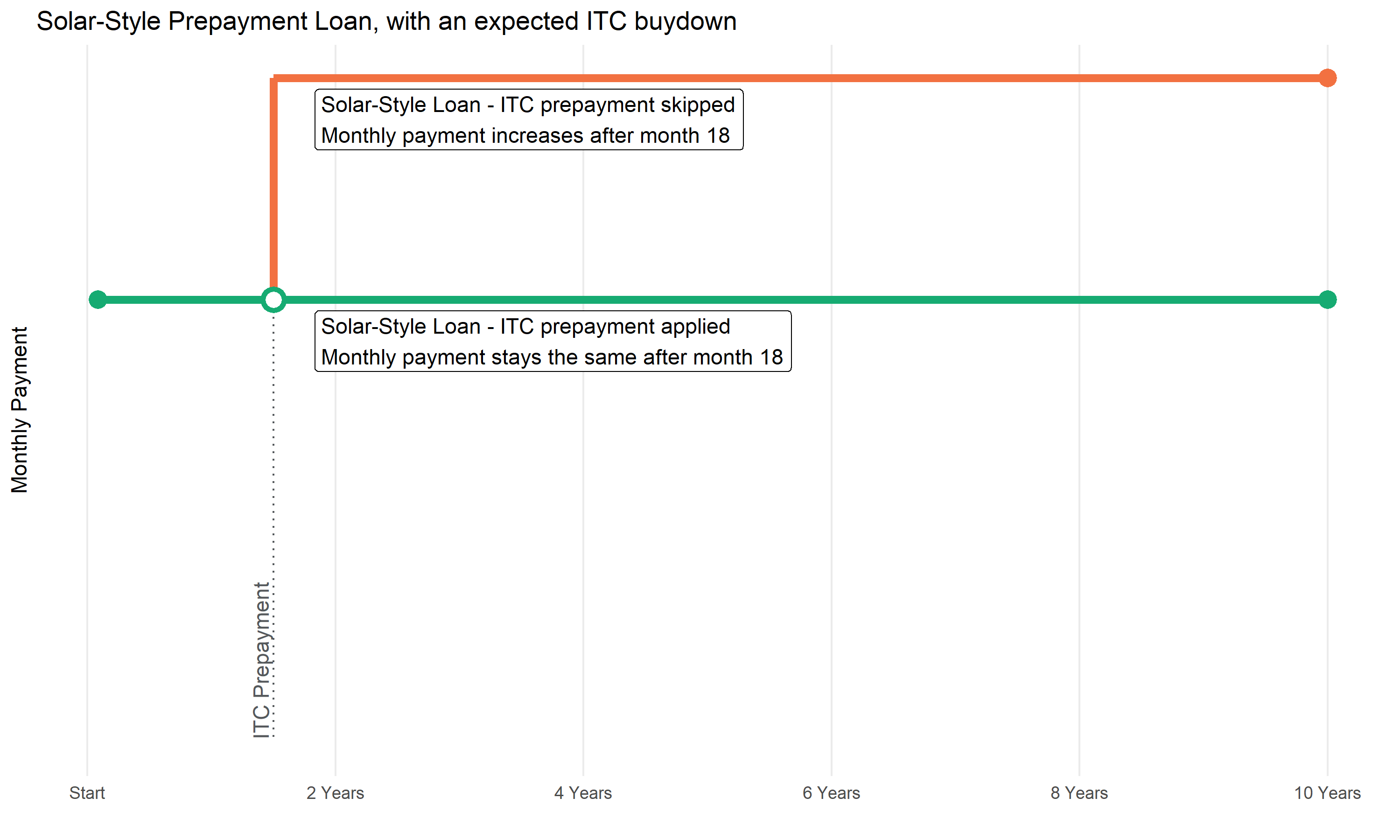

Solar-Style Loans (expected ITC prepayment)

Many solar loans on the market are set up so that the system owner pays a flat amount for the duration of their loan, and also make a one-time paydown sometime in the second year using their ITC savings from their federal tax return. These loans also have a grace period included to account for the time it takes for the owner to receive permission to operate from their utility provider. This is assumed to be 1 month in Aurora - if your loan has a different grace period, please let us know so we can discuss how to add that in the future.

To model these loans in Aurora, pick the Solar-Style Loan, and enter the loan duration, interest rate, and expected prepayment amount and month as stated by the loan provider. The loan principal will usually be 100% of the system cost.

Skipping the Prepayment

The owner is not required to make the early buydown if they choose to keep their federal tax credit for other purposes, but skipping the buydown will result in higher monthly payments until the completion of the loan. To model this, simply deselect the “Prepayment will be completed?” checkbox to model the effects.

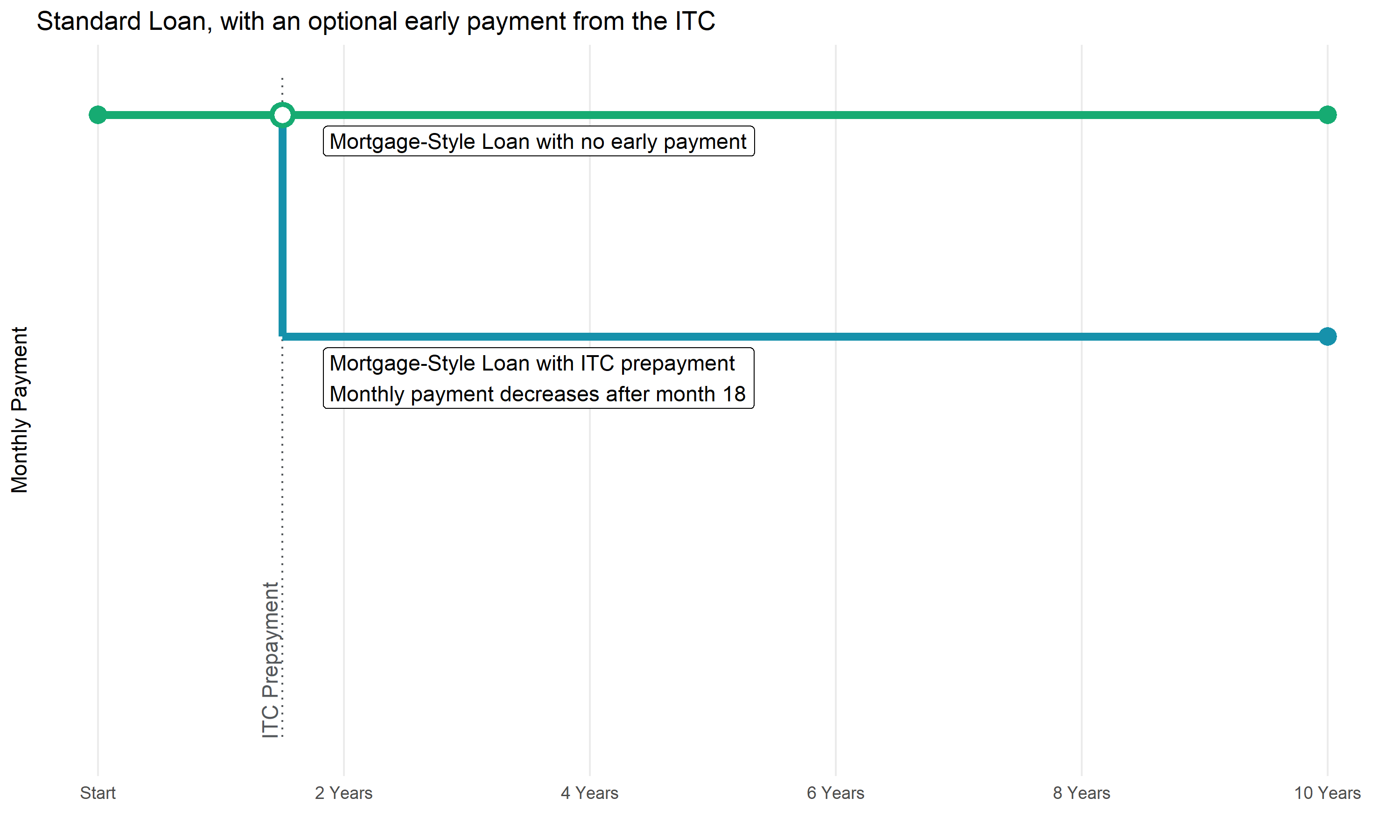

Mortgage-Style Loans

Standard loans, also referred to as “mortgage-style” loans, feature a flat monthly payment for the life of the loan. These are common not only for home mortgages, but also car and student loan payments. Monthly payments first offset any accrued interest, followed by the loan’s principal.

PV system owners who finance their system with a mortgage-style loan can usually apply their Federal ITC tax credit to the loan principal as a one-type prepayment. Lenders that offer this type of loan usually accept a one-time prepayment with no added costs. The prepayment reduces the remaining principal on the loan, which reamortizes the loan and results in a lower payment for the remaining duration.

Pro Tip: the principal and interest payments for a Mortgage-Style Loan will return the same values as the IPMT and PPMT functions in Excel. You can easily replace excel workbooks with Aurora financial modeling.

HELOCs

Home Equity Line of Credit is a good option for homeowners, as they feature a lower interest rate than most unsecured loans. These are set up in the same way as a Mortgage-Style loan, but because solar is a home improvement investment, the homeowner may be able to deduct the interest paid on the loan from their tax liability. The homeowner should consult their CPA for advice on whether they can claim the interest as a tax deduction.

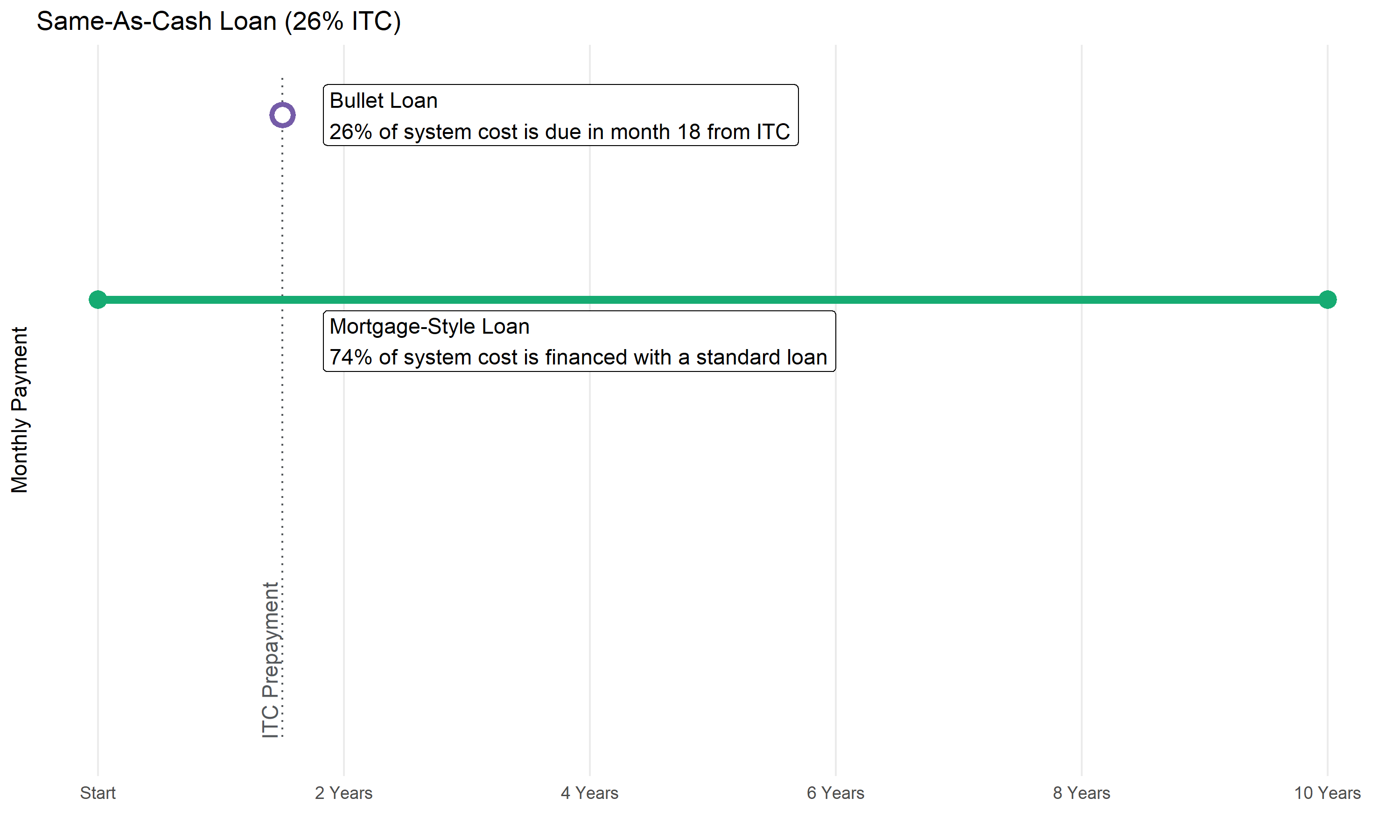

Bullet Loan

The same-as-cash or Bullet Loan is an attractive option for PV owners, since they never have to pay out-of-pocket for the ITC-covered portion of their new system. With this loan, the owner receives a zero-interest, no-payment loan for anywhere from 14-18 months. They pay off the bullet loan when they receive their federal tax credit for the system. If the bullet loan is not paid off, it will typically convert to a normal pay-down loan.

Bullet loans can be set up in tandem with a standard loan to cover the whole cost of the system.To set this up, select the first loan as a Bullet Loan and enter the principal amount as the ITC value (26% in 2020), and then set up a second loan as the remaining principal amount.

Interest-Only Loans

In an interest-only loan, the system owner will only pay off the accrued interest for the specified interest-only period. After the interest-only period ends, the loan converts to a mortgage-style loan and is paid down during the remaining time frame. A portion of the loan can also be paid down at any time during the loan.

No-Payment Loans

In a no-payment loan, the system owner makes no payments during the specified no-payment period. If the interest rate is non-zero, interest will accrue during this no-payment period. After the no-payment period ends, the loan converts to a mortgage-style loan and the owner pays down the original principal and any accrued interest during the remaining duration. A portion of the loan can also be paid down at any time during the loan.

In some solar-specific loans, the system cost is divided into an ITC portion and a non-ITC portion. The non-ITC portion is treated as a normal mortgage-style loan, and the ITC portion is treated as a bullet loan with no interest. If the customer does not complete a paydown, the ITC portion is treated as a no-payment loan

For more information on how to add Financing Products, check out this article from our Help Center - Financing Products